Late Payment Compensation for IP’s

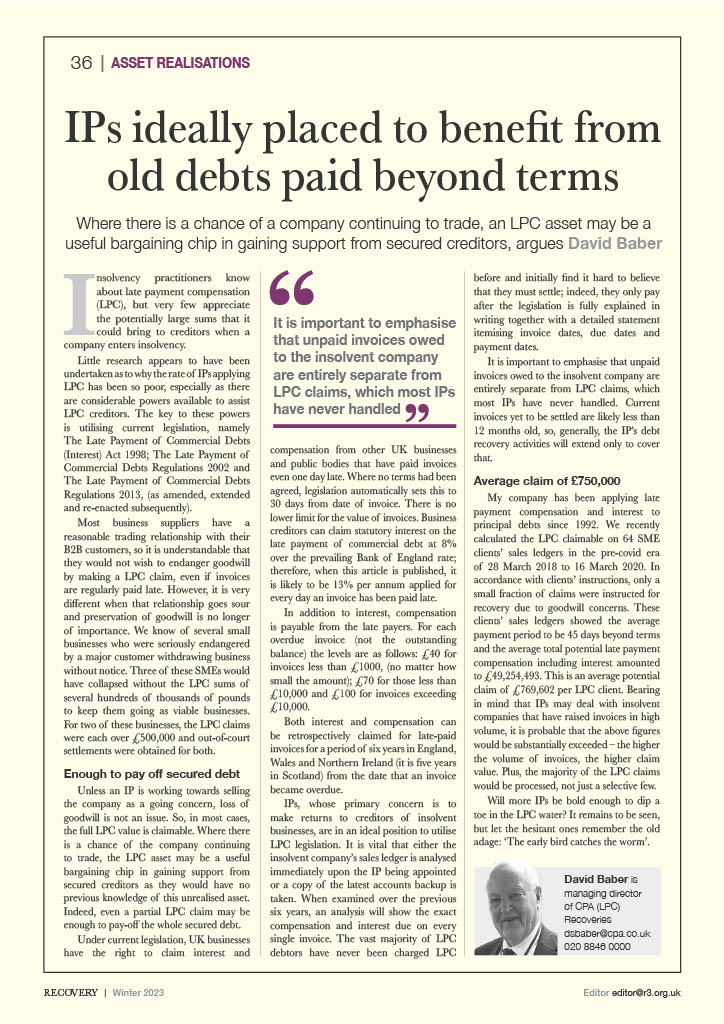

Insolvency practitioners know about late payment compensation (LPC), but very few appreciate the potentially large sums that it could bring to creditors when a company enters insolvency.

Little research appears to have been undertaken as to why the rate of IPs applying LPC has been so poor, especially as there are considerable powers available to assist LPC creditors. The key to these powers is utilising current legislation, namely The Late Payment of Commercial Debts (Interest) Act 1998; The Late Payment of Commercial Debts Regulations 2002 and The Late Payment of Commercial Debts Regulations 2013, (as amended, extended and re-enacted subsequently).

Most business suppliers have a reasonable trading relationship with their B2B customers, so it is understandable that they would not wish to endanger goodwill by making a LPC claim, even if invoices are regularly paid late. However, it is very different when that relationship goes sour and preservation of goodwill is no longer of importance. We know of several small businesses who were seriously endangered by a major customer withdrawing business without notice. Three of these SME’s would have collapsed without the LPC sums of several hundreds of thousands of pounds to keep them going as viable businesses. For two of these businesses, the LPC claims were each over £500,000 and out-of-court settlements were obtained for both.

Unless an IP is working towards selling the company as a going concern, loss of goodwill is not an issue. So, in most cases, the full LPC value is claimable. Where there is a chance of the company continuing to trade, the LPC asset may be a useful bargaining chip in gaining support from secured creditors as they would have no previous knowledge of this unrealised asset. Indeed, even a partial LPC claim may be enough to pay-off the whole secured debt.

Under current legislation, UK businesses have the right to claim interest and compensation from other UK businesses and public bodies that have paid invoices even one day late. Where no terms had been agreed, legislation automatically sets this to 30 days from date of invoice. There is no lower limit for the value of invoices. Business creditors can claim statutory interest on the late payment of commercial debt at 8% over the prevailing Bank of England rate; therefore, when this article is published, it is likely to be 13% per annum applied for every day an invoice has been paid late.

In addition to interest, compensation is payable from the late payers. For each overdue invoice (not the outstanding balance) the levels are as follows: £40 for invoices less than £1,000, (no matter how small the amount); £70 for those less than £10,000 and £100 for invoices exceeding £10,000.

Both interest and compensation can be retrospectively claimed for late-paid invoices for a period of six years in England, Wales and Northern Ireland (it is five years in Scotland) from the date that an invoice became overdue. Thus, if a supplier had been trading regularly with a late-paying customer over several years, the total claim could be substantial.

IPs, whose primary concern is to make returns to creditors of insolvent businesses, are in an ideal position to utilise LPC legislation. It is vital that either the insolvent company’s sales ledger is analysed immediately upon the IP being appointed or a copy of the latest accounts backup is taken. When examined over the previous six years, an analysis will show the exact compensation and interest due on every single invoice. The vast majority of LPC debtors have never been charged LPC before and initially find it hard to believe that they must settle; indeed, they only pay after the legislation is fully explained in writing together with a detailed statement itemising invoice dates, due dates and payment dates.

It is important to emphasise that unpaid invoices owed to the insolvent company are entirely separate from LPC claims, which most IPs have never handled. Current invoices yet to be settled are likely less than 12 months old, so, generally, the IP’s debt recovery activities will extend only to cover that.

My company has been applying late payment compensation and interest to principal debts since 1992. We recently calculated the LPC claimable on 64 SME clients’ sales ledgers in the pre-covid era of 28 March 2018 to 16 March 2020. In accordance with clients’ instructions, only a small fraction of claims were instructed for recovery due to goodwill concerns. These clients’ sales ledgers showed the average payment period to be 45 days beyond terms and the average total potential late payment compensation including interest amounted to £49,254,493. This is an average potential claim of £769,602 per LPC client. Bearing in mind that IPs may deal with insolvent companies that have raised invoices in high volume, it is probable that the above figures would be substantially exceeded – the higher the volume of invoices, the higher claim value. Plus, the majority of the LPC claims would be processed, not just a selective few.

Will more IPs be bold enough to dip at least one toe in the LPC water? It remains to be seen, but let the hesitant ones remember the old adage: ‘The early bird catches the worm’.

David Baber is Managing director of CPA.

dsbaber@cpa.co.uk

020 8846 0000

The Credit Protection Association Limited is a member of the Credit Services Association and is committed to their code of practice.

Links to relevant LPC legislation

The Late Payment of Commercial Debts Regulations 2013

The Late Payment of Commercial Debts Regulations 2002

Late Payment of Commercial Debts (Interest) Act 1998

THE LATE PAYMENT OF COMMERCIAL DEBTS (INTEREST) ACT 1998

AND

THE LATE PAYMENT OF COMMERCIAL DEBTS REGULATIONS 2013

as amended, extended or re-enacted

Where payments are not made by the agreed date the provisions of the Act apply and both interest and compensation is payable by law.

Section 1 of the Act states, Inter Alia “It is an implied term in a contract to which this Act applies that any qualifying debt created by a contract carries simple interest subject to and in accordance with this part”

The Act also states in section 5A

(1) Once statutory interest begins to run in relation to a qualifying debt the supplier shall be entitled to a fixed sum (in addition to the statutory interest on that debt.)

(2) That sum shall be:-

- For a debt of less than £1,000, the sum of £40

- For a debt of £1,000 or more but less than £10,000 the sum of £70

- For a debt of £10,000 or more, the sum of £100

Statutory interest is calculated at an annual rate of 8% plus the Bank of England base rate on the overdue debt and then divided by 365 to give a daily rate which is then multiplied by the total number of days the debt was overdue.